This is the single worst experience with any trading service to date. We strongly advise anyone who values their hard-earned cash, sleep and overall stress levels to not touch this service with a 10-foot barge pole. Its extremely high risk, low win rate, extremely high drawdowns and most concerning is that this was mostly during 2020 a period of very low volatility.

Overview

We spent more than 12 months subscribed to their Paragon Options service that comes in at a hefty fee of $200 per month. In a nutshell the objective is to pick key turning points and use very complex option strategies often with 4-10 individual positions to make up the single trade. Admittedly they do use RSI in a unique and innovative way, probably one of the only tidbits of value I got from 12 months of this service

The AOC team for Paragon Options consists of three members Stan, Jack and Matt. Stan who uses a modified version of Elliot Wave, Jack who uses standard Technical Analysis mainly key levels, trendlines and chart patterns such as triangles. Matt is their options guy, who creates complex options strategies based on Stan and Jacks TA. The basic approach is to use TA to pick key turning points in Futures mainly ES, GC and CL. Then use complex options strategies using a range of spreads, risk reversals and butterflies to navigate the turns.

Strategy

This is also where it all goes horrible wrong, it is notoriously difficult to pick tops and bottoms, and the TA for Stan and Jack, was almost always wrong. In fairness Matt is very good at what he does but was almost always put on the wrong side. Most positions would start as straight directional plays, that then go quickly off-side due to incorrect TA and then Matt would have to go into repair mode. That required many additional in-depth layers of hedging, delta-hedging, gamma-hedging, then re-hedging. The TA was so often wrong, that it was barely ever about the direction, it was about just surviving, and adding so many layers that the option premiums would eventually cover the directional losses.

Worse, the options strategies often favored the sell-side, because a key part of the strategy is about leveraging option premium. Which seems like a great strategy, except when things go wrong, which was very often, and you get caught with multiple naked short option positions

The most common scenario you will experience: The Paragon team will step in front of a freight-train market such as Oil (CL) because of an expected Elliot Wave turning point, adding a position something like 2 long put’s, 4 short putt and CL would then smash through both positions causing heavy losses. The Paragon team would then go into repair mode, adding hedge after hedge whilst you watch you account taking a whipping. Like in the case of ES, after running a short position for 9 months, continued to hedge so much that the position flipped long, right at 3400, then got destroyed via the Covid19 crash.

Risk Management

Probably the worst I have ever seen, the recommend account size to trade Paragon Options is $100K and to be honest I lost track of how many times a position was down more than $50k. In the big Natgas (NG) blowup in 2019, their position was nearly $80K under water. With their ES positions, they were heavy short positioned from in 2019, from around 2500, and continued to be heavy short all the way up until 3400, where they flipped with 4 long ES futures, right before the Covid19 crash, that single position lost $75K.

Further adding to this is the extremely complex nature of the options positions. There were many times when these positions were pushing me to max pain but you cannot escape, as the positions have become incredible complex with layers upon layers of options to hedge, re-hedge, delta-hedge, gamma-hedge and then hedge. In vast majority the position is in heavy unrealized losses, right until few days before expiry once all the premium is sucked out of the options position.

Art of Chart Paragon Options Part Deux Q4 2021 and Q1 2022

Call it morbid curiosity, glutton for punishment or a perpetually optimistic outlook we decided to give the guys at ArtofChart another go, and the Paragon Options Service. Honestly, it is hard to believe but they have not learnt any lessons and are still continuing to obliterate people’s account with the same strategies.

Let’s look at real-life example trade:

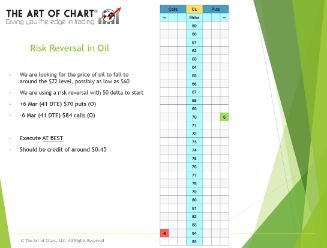

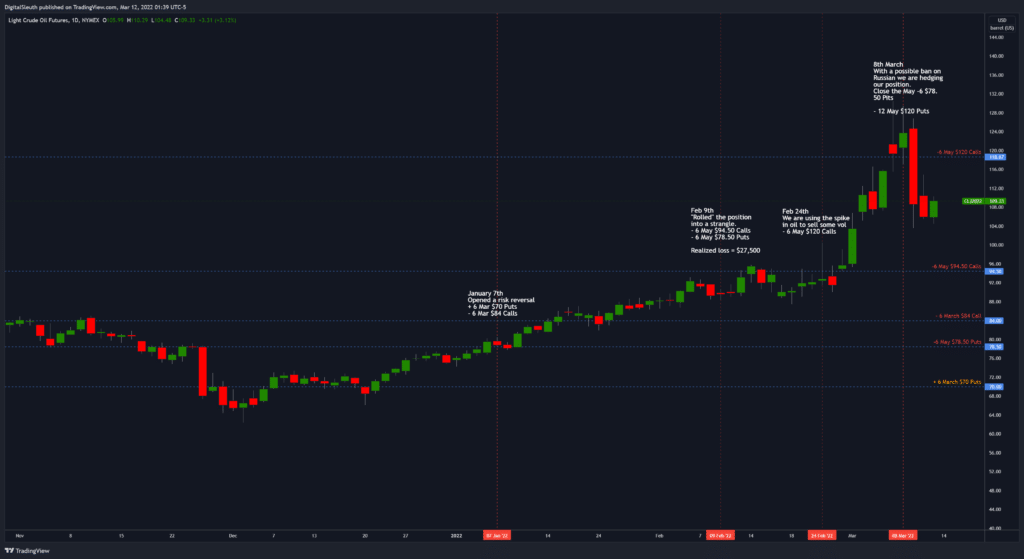

7th January

Trade alert: “we are looking for the price of oil to fall to around $72, possible as low as $60, as such we are putting on a risk reversal with a 50 delta to start”

+ 6 March $70 Puts

- 6 March $84 Calls

Oil (CL) Current Price: $78.75

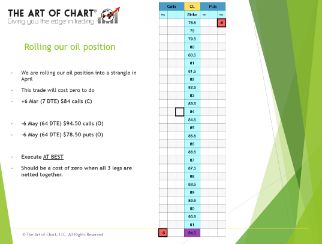

9th February

Trade alert: "We are "rolling" out position into a strangle in April". We added the quotions to "rolling" as in our opinion this is deceptive language, this is not rolling, it is booking a loss but with calling it a loss.

Realized loss: $27,300

New Position:

-6 May $94.50 Calls

-6 May $78.50 Puts

Oil (CL) Current Price: $89.50

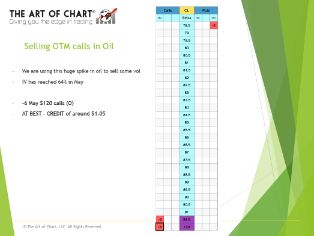

24th February

Trade alert "We are using this huge spike in oil to sell some vol, IV has reached 64% in May"

-6 May $120 Calls

Oil (CL) Current Price: $92.88

Current unrealized: -$75,000

New Position Adjustment: 8th March

Close the May $78.50 Puts

Add: -12 May $120 Puts

Oil (CL) Current Price: $123.84

Current unrealized: -$163,000

Here are all the trade alerts from the site for verifcation:

|  |

|  |

Here is the the whole scenario outline on a chart:

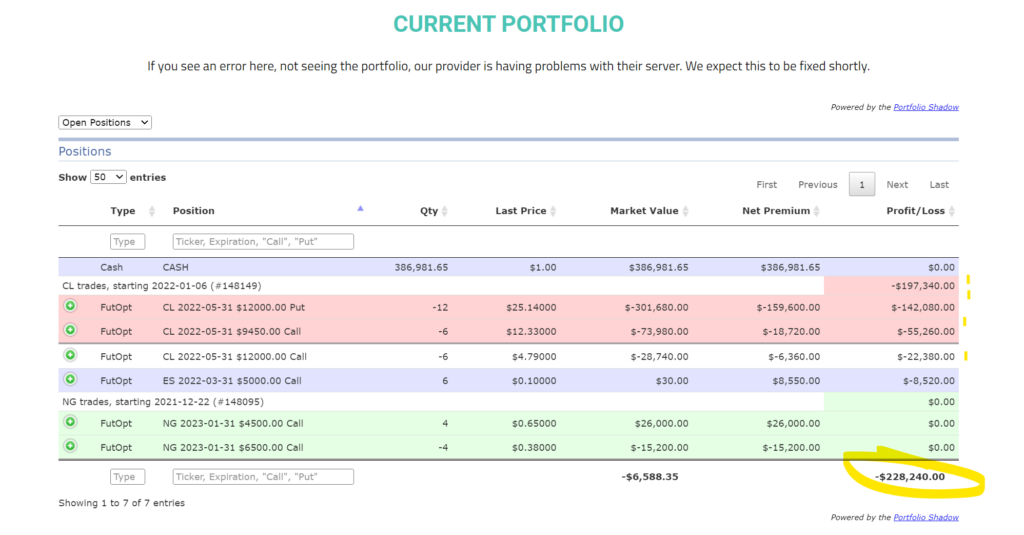

We need to call out that this trade still has 30 days to run, and whilst it still presents extreme risk, could still turn around and generate a significant profit. However, we do not believe this is the point, this program is aimed at retail traders, not institutional trades and how many retail traders have accounts that can withstand a $250,000 drawdown on a trade. We do not have proof, and so this is an assumption but we expect many traders would have lost their account on this trade. As the margin requirements exploded with the Russian invasion, there would have been significant margin calls that if not satisfied would have resulted in forced liquidation, likely right at the bottom.

If you think we are being dramatic with the drawdowns take a look at screenhsots for Art of Charts own portfolio management tool:

Summary

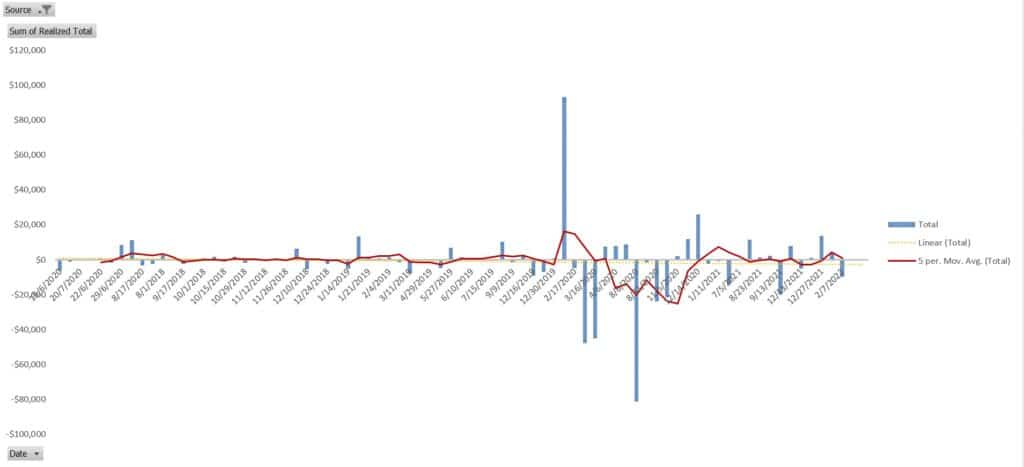

The real world results speak for themselves. We have followed trades from Paragon Options from 15th July 2020 until this current Oil trades outline above. As you can see from the graph below, these are out actual trades, and you can see highly erratic trading with large wins and large losses.

Overall Results: -$66,631 exlcuding the current Oil trade.

Sadly, whilst this is the worst trade example, it is not out of the ordinary, as previously discussed it is common for trades to $50k into the red as the norm. Again, we advise extreme caution with this service for the majority of retail traders this is a one-way ticket to destruction. If you are a high roller have a big 6 figure account, and enjoy white knuckle rides this could be an option.

The Art of Chart Paragon Options Review $199

-

Education - 10%10%

-

Insights - 9%9%

-

Suport - 15%15%

-

Vaue - 3%3%

Summary

This is the single worst experience with any trading service to date. We strongly advise anyone who values their hard-earned cash, sleep and overall stress levels to not touch this service with a 10-foot barge pole. Its extremely high risk, low win rate, extremely high drawdowns. We advise extreme caution with this service for the majority of retail traders this is a one-way ticket to destruction. If you are a high roller have a big 6 figure account, and enjoy white knuckle rides this could be an option.