Name: The Kobeissi Letter

Website: www.thekobeissiletter.com

Length of subscription: 12 months

Market during subscription: Bullish grinding upwards

Type of service: The Kobeissi Letter

Price: $89.99 per month

Trial Review

Style

The service is positioned as a weekly calls service, each week a newsletter comes out that outlines typically 5 trades: SPX, Gold, Oil, Bonds, Nat Gas as either bullish, bearish or neutral. In addition, on their Premium Twitter feed Day Trades are outlined quite frequently, maybe on average once pr day across a range of instruments. We found the day trades to be significantly more accurate than their weekly newsletter trads outlined in the newsletter, yet, as you know if a regular reader we mainly focus on swing trading, as don’t want to be watching the market all day, waiting new trades to pop up on a Twitter feed.

Strategy

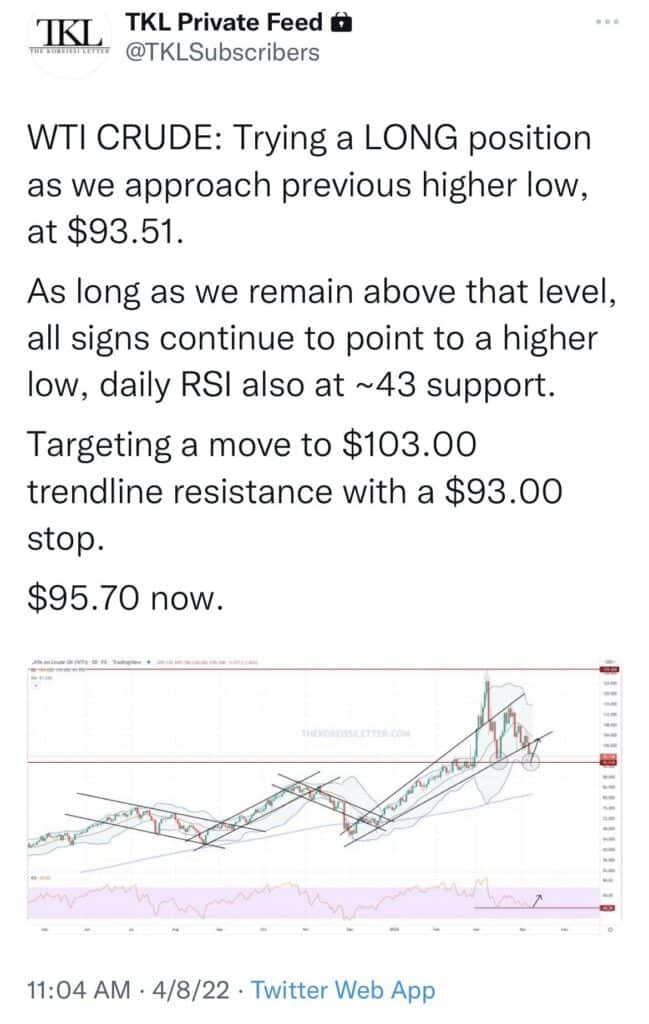

Kobeissi is based on Technical Analysis, in what appears to be simple support and resistance type trading, and level to level trading. There is an element on mean-reversion, as most trades are extended with a rebound to a support trend lines such as the below trade. This plays well into the weekly newsletter so that trades often last a few days in duration.

Management

Due to the way the trades are setup as weekly trades, little management is required. However, the Kobeissi team are good at updating via their Premium Twitter when entering and exiting called trades.

Price

Price is on the average end on most services at $89.99 a month, and does represent good value as you get the weekly newsletter which includes the five trades and a fair amount of macro and technical analysis to outline and support the trades. This information would be educational for new traders and support developing a personalized trading strategy.

Education

There is limited to no educational material, however the information in the newsletter would be educational for new traders and support developing a personalized trading strategy.

Support

We didn’t use any support but the service operators do appear to respond to questions through Twitter.

Risk Management

The Kobeissi Letter is more of a trade positioning service, and does not specially call trades. The trade parameters, vehicle used such as whether futures, or efts, or options is down to the read to select.

Real Life Performance

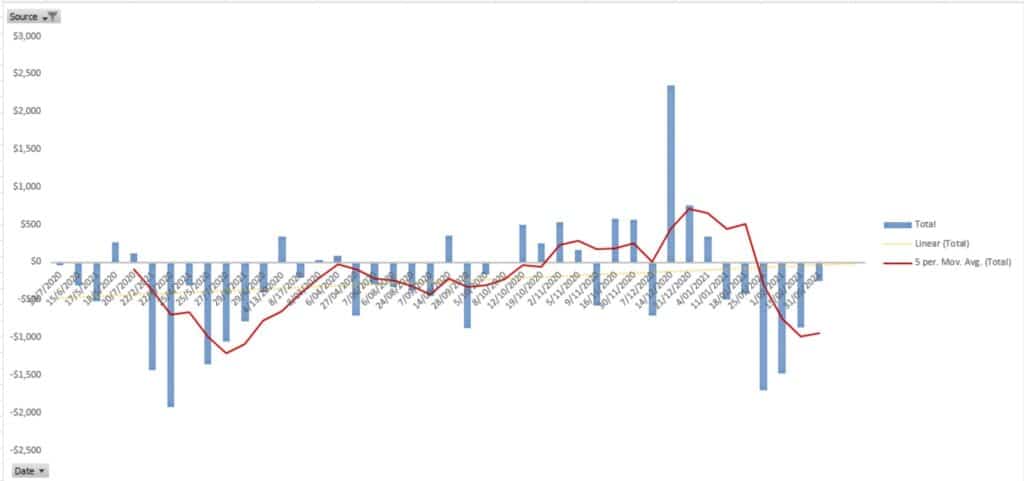

Overall this looked to be a solid trading service with a good level of information across a range of trading vehicles, and aligned to our short term swing trading approach. Kobeissi outline detailed performance on their website, yet our real-world testing did not come anywhere near the stated performance on the website.

12 Months Real World P&L: -$10,621

As can be seen below, by looking at the re-line trend, it was down below zero the majority of the time, this shows that it was consitently on the wrong side of trades, it was not a few big losses of risk management issues but a sustained under-performance and low trading accuracy.

Summary

We had high hopes for this service, as it aligned well with the desired low involvement trading approach, by setup weekly trades. Had strong performance listed on the website, appears to get good feedback on their Twitter feed … however, yet again, real-world results are very disappointing. Kobeissi Letter appears to be a lot of hype and marketing, with no real edge, and a long-term unprofitable low accuracy trading. Overall this is the 3rd large loss we have incurred from a trading service. We do have call out the below disclaimer, this was our experience others may have a different one …

Disclaimer:

Our reviews are based purely on our own opinions and experience during the trial period, they are not an endorsement or critique of any particular service no matter how positive or negative our review, it is all only our personal experience. None of the reviews are trading advice or a recommendation to join or purchase any product. Trading is very subjective, based on personal styles, preferences, and lifestyles. As such the experience we have may not be your experience. In addition, the market is highly dynamic, reviews are strongly affected by the market condition and movement at the time of the trial, the results we got might be completely different at a different point in time. Last, trading is a very endeavor for all traders no matter how good have ups and downs, it is part of trading, therefore we cannot rule out that any particular review was conducted during a down patch, or at a time when the market was unsuited to that strategy. In short, much like trading, consider this only one part of a larger puzzle, do your own research, and make your own informed decisions.

The Kobeissi Letter

-

Education - 50%50%

-

Strategy - 31%31%

-

Insights - 31%31%

-

Suport - 46%46%

-

Vaue - 34%34%

-

Profitability - 12%12%