From all the tools, services and products tested, Amibroker is one that should be classed as mandatory. First the price is great value with the Standard package coming in at $239, the Professional at $339 and the Ultimate at $499. The main difference that the ultimate comes with AmiQuote - a stock quote downloader from multiple on-lines sources featuring free EOD and intraday data and free fundamental data & AFL Code Wizard - a tool that helps creates AFL formulas out of plain English sentences, a really helpful learning tool for novices. All this is extremely good value in the trading niche, and back testing space. One caveat I would add is that the free data services are not great, if you want to take it serious, and you should if you plan to trade real money you will need to investment in real data, I am using Norgate Premium, that costs about $25 a month for US Stocks and $20 a month for US Futures. Our suggestion is to take the Professional package, learn AFL as you will need it, and use the savings to buy quality data.

Core Benefits

Easy of use, I taught myself to be fairly self-proficient in Amibroker in a few weeks, there is a ton of free training and a huge resources of example from trading systems, code snippets, indicators, system components and just about everything you could ever need. In fact, I have basic knowledge of AFL the Amibroker coding language but barely ever need to code complex items as I just find and reuse other code from onlien systems, and the Amibroker forum make it easy to find example of code in other systems.

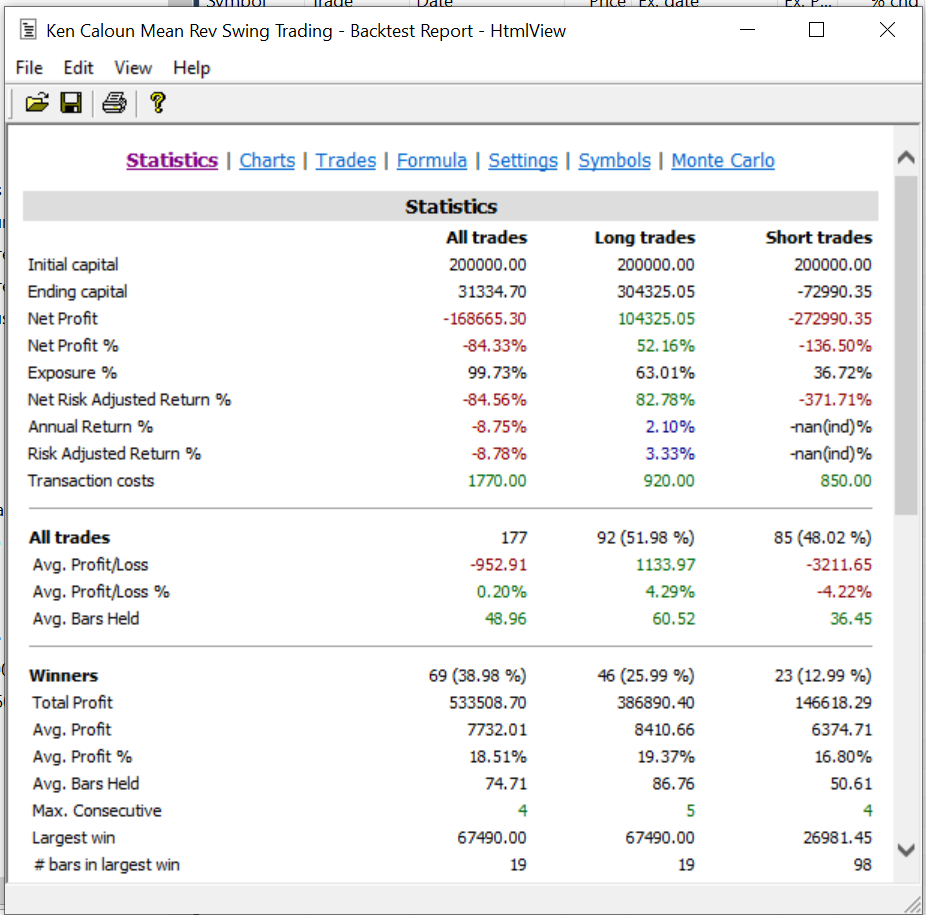

Trading knowledge, once you start back testing systems you build hugely valuable knowledge of trading probabilities, systems, indicators and overall success rates. I really wish I had gained this knowledge earlier, so I could have known all the BS so called trading guru’s talk, such as their 21MA Keltner Strategy that delivers huge consistent gains, yet when you test every conceivable permutation of moving average with Keltner Channels you quickly realize the edge is tiny at best, maybe 1, 2 or 3% per year with heavy drawdowns. This understanding alone will make you a much better trader and see through so much marketing hype.

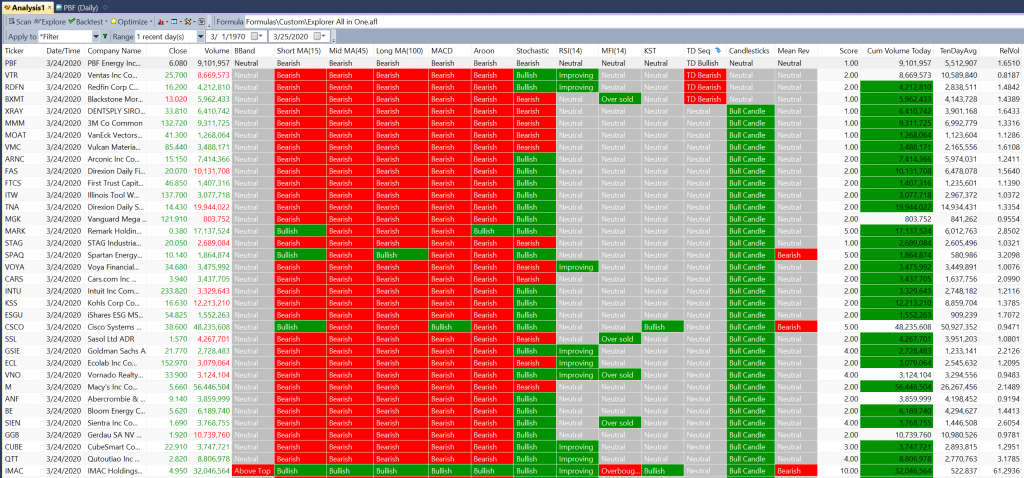

Amibroker is also a robust trading scanner, every system can be tweaked to scan and explore for a certain types of setup. You can also quickly build visualization tools that can evaluate a stocklist or watchlist for trend following, pullback or any other type of setup. See example below. Pulling lists of stock from other platform such as unusual then uploading into Amibroker for additional evaluation is a key area of our stategy.

Other excellent features include Monte Carlo Analysis, online support, code base and forum and a solid 3P market for additional features such as pattern scanners, adaptive indicators and neural networks.

Scoring & ranking. If multiple entry signals occur on the same bar and you run out of buying power, AmiBroker performs bar-by-bar ranking based on user-definable position score to find preferable trade.

Find optimum parameter values. Tell AmiBroker to try thousands of different parameter combinations to find best-performing ones. Extremely handy, ever wanted to test which moving average type and period works bets in a moving average cross-over system, well with Amibroker you can test multiple types and periods quickly and easily.

Walk-forward testing, is another very important feature to prevent curve fitting, a very real threat in system design. As you learn you will get caught up in the trap bu constantly tweaking setting and running the backrest till you find a set of parameters that work amazingly well, only to find that these only work on the one sample of data.

-

Education - 43%43%

-

Strategy - 87%87%

-

Insights - 89%89%

-

Suport - 47%47%

-

Vaue - 74%74%

-

Profitability - 83%83%